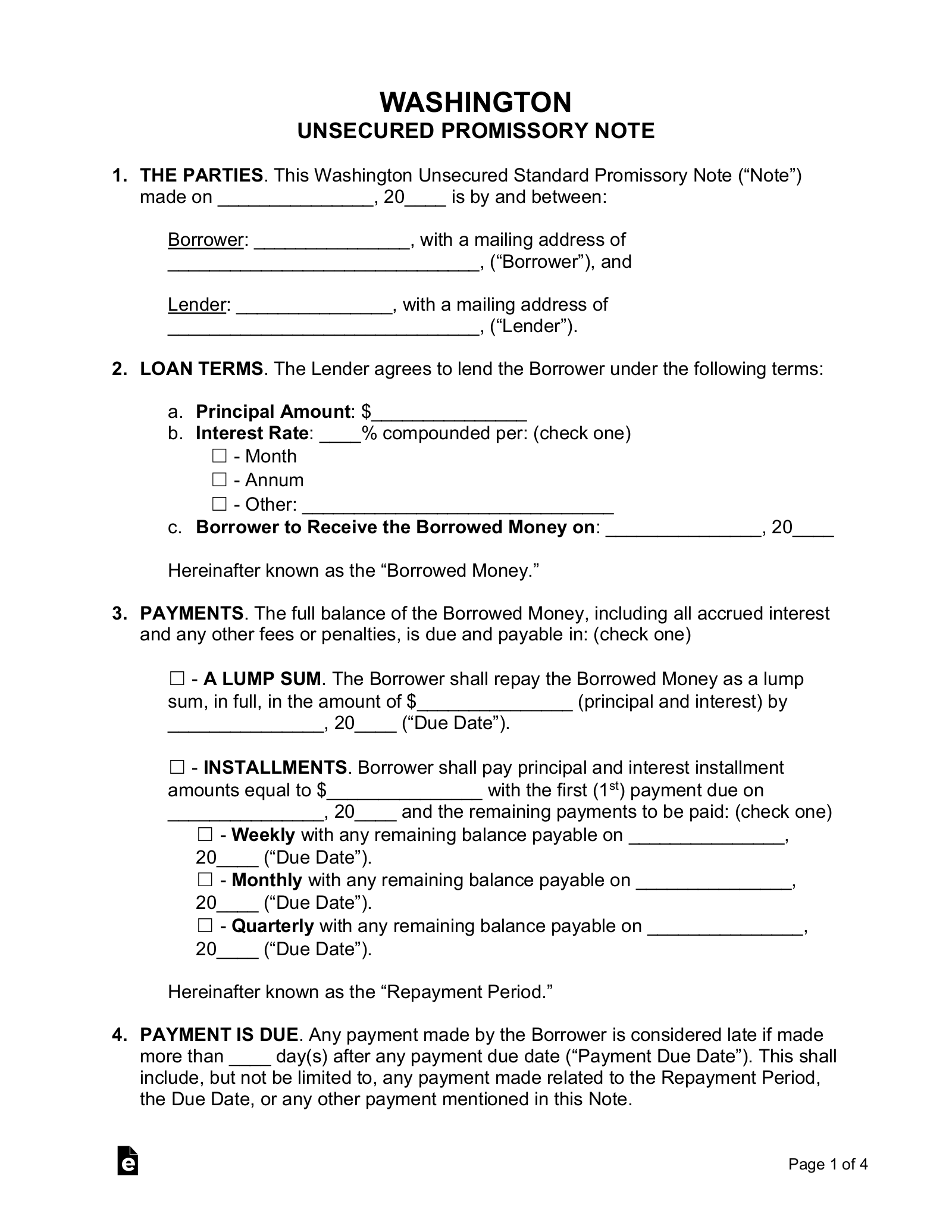

California Unsecured Promissory Note Template. The California promissory note templates are documents designed to add security and structure to agreements involving the lending of money between two parties. An unsecured promissory note is a financial instrument which showcases some written promise to repay a given amount of money in the future or on-demand.

When a note is secured, there is an asset, such as a home or something else of value that the lender can obtain if the borrower defaults on the loan (or even misses one payment).

A Promissory Note, also sometimes called an IOU, is essentially an enforceable promise to pay back a loan or debt in which borrower of money (most often just called the Borrower) agrees to repay a lender (the Lender).

Learn how to draft your own promise to pay letter using our simple promissory note examples. California promissory notes are created for the purpose of adding security and format between two parties when lending money is involved. As a result, the maker doesn't grant the note holder an interest in the property to assure the payee against the risk of default risk.