Capital Lease Test Template. Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other The two most common types of leases in accounting are operating and financing (capital leases). Hi there, I was wondering if anyone has or knows where I can access an Excel Template to test Operating Lease vs.

Select a fair value template, which includes the valuation method, level and premise.

Despite being off-balance sheet assets and liabilities, I have always included the effects of operating leases in models.

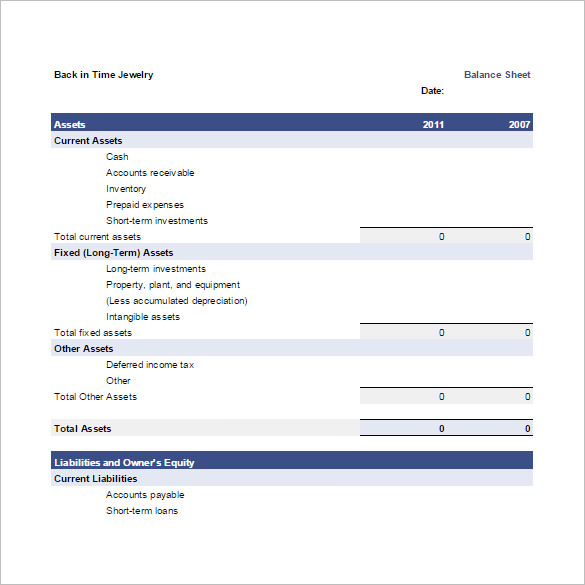

The leasing of a certain asset may—on the surface—appear to be a rental of the asset, but in substance it may involve a binding agreement to purchase the asset and to finance it through monthly payments. There are four criteria an asset must meet to be capital, but once it's determined to fit in that With a capital lease, payments are considered both a liability and an asset on the firm's balance sheet because the business assumes some of the risk of. When your business leases equipment rather than buying it, there are two ways you could handle the lease in your accounting.