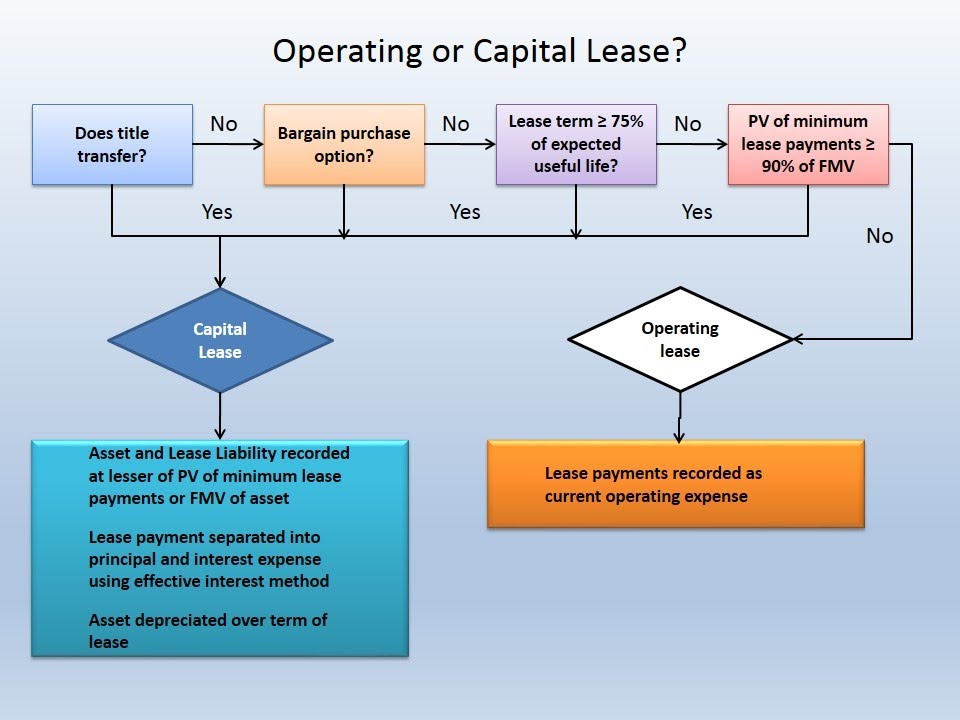

Capital Lease Example Accounting. Capital lease accounting shows treatment of assets taken on lease by the business under a capital lease agreement with the lessor. A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset.

To account for a capital lease, familiarize yourself with the terms of the arrangement and make the appropriate journal entries.

A lease cannot be capitalized at a higher value than the fair market value, so an interest rate must be calculated which will cause the present value of the rents at that.

Learn vocabulary, terms and more with flashcards, games and other study tools. Although they aren't technically loans, capital leases are treated much like loans in a business's accounting. Delta transactions if treated as an capital lease.