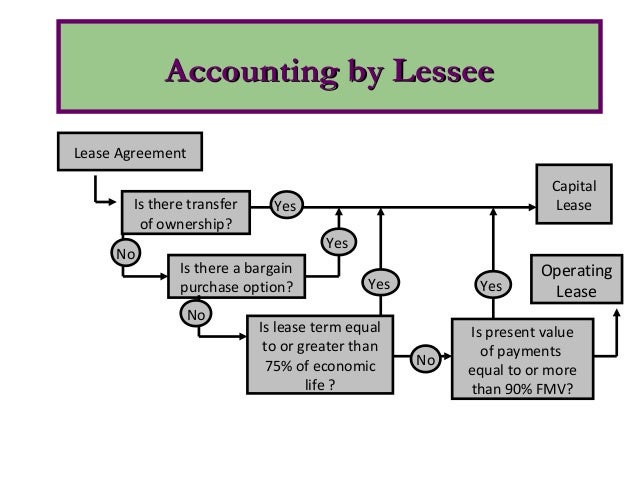

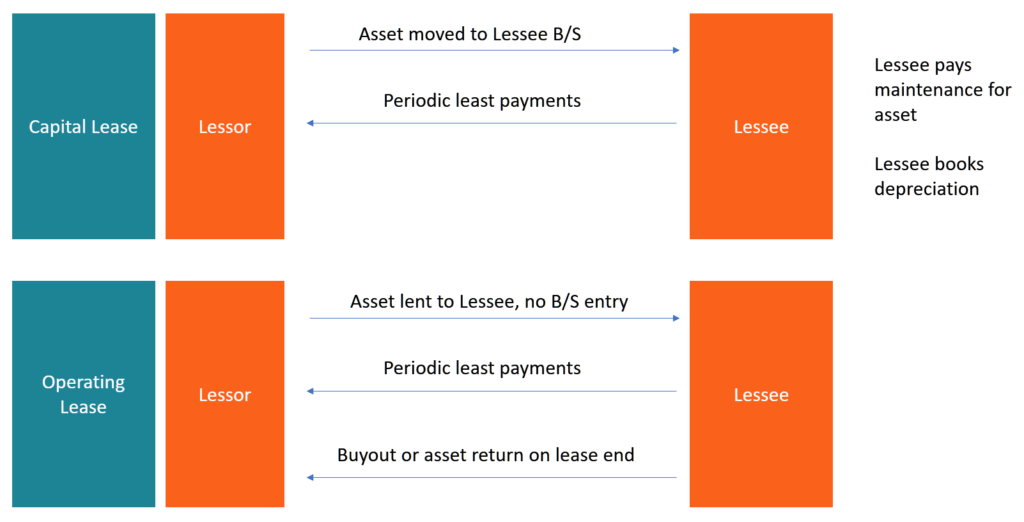

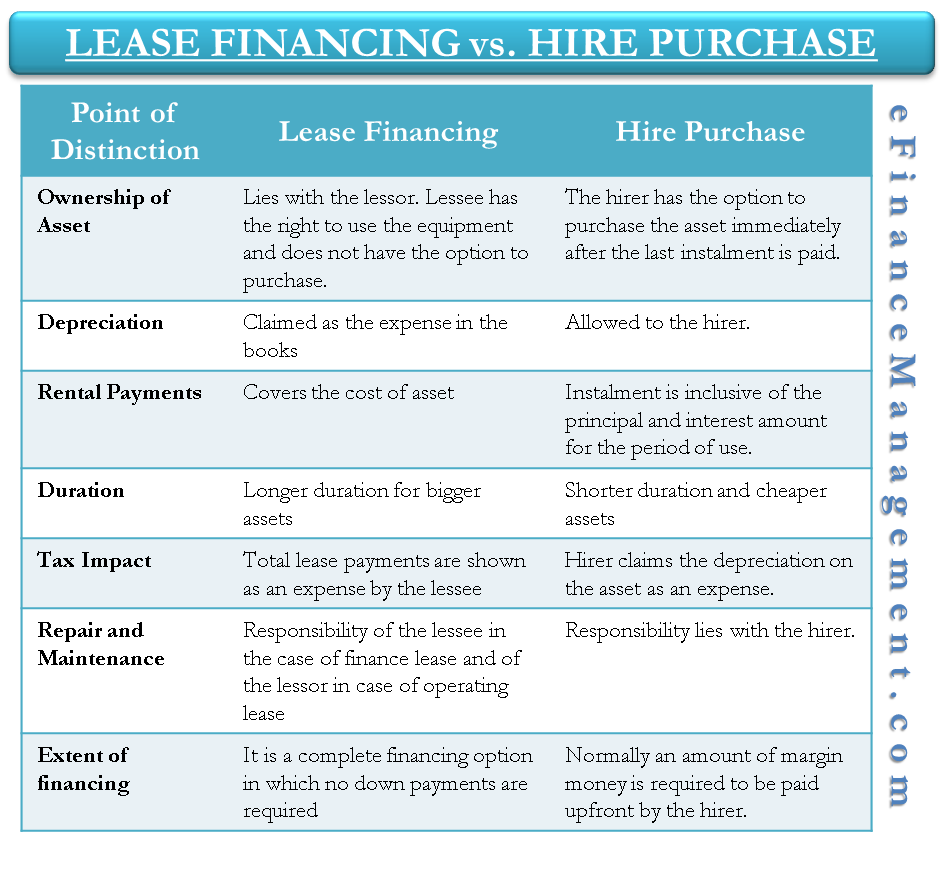

Capital Lease Agreement Accounting. When you take out your capital lease, first debit the Building asset account for the total cost and credit the Lease. A capital lease or finance lease is an agreement between the business (lessee) to rent an asset from a lessor.

This is one of the biggest changes between the old and new lease accounting standards.

But don't worry — by the time you get to the end of this section, you'll be working through the lessee capital lease accounting like a pro!

To record a capital lease, one treats it similarly to a depreciable asset. Capital lease accounting shows treatment of assets taken on lease by the business under a capital lease agreement with the lessor. The asset is depreciated as normal over the term of the.

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)