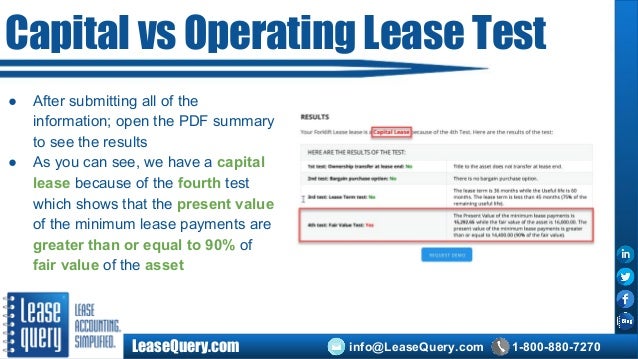

Capital Lease Accounting Pdf. Here we discuss the accounting treatment of capital lease along with step by step examples and journal The accounting for capital lease is done considering the property to be owned by the lessee and recording such property as a fixed asset in. Accounting for Capital Leases - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

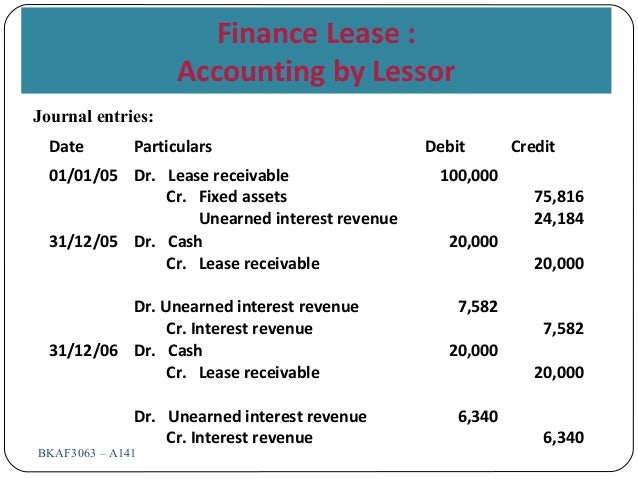

The rentals are considered to be revenue to the owner-lessor and expenses to the tenant-lessee.

The example below illustrates the accounting for capital leases and the effect on the financial statements from treating this sort of lease as essentially identical to the purchase of an asset with a.

Here we discuss the accounting treatment of capital lease along with step by step examples and journal The accounting for capital lease is done considering the property to be owned by the lessee and recording such property as a fixed asset in. Insourcing provides more direct, hands-on control, but it requires dedicated resources as well as technical and lease accounting experience. For the lessee, capital leases affect both the asset and liability sections of the balance sheet.