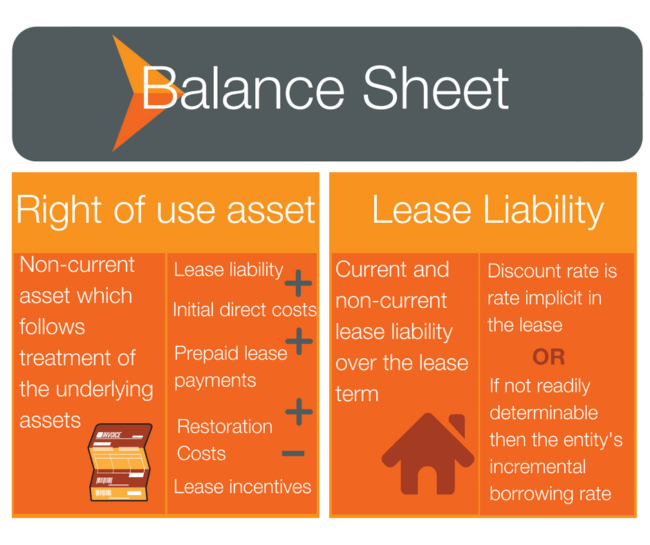

Capital Lease Accounting Example Lessee. Leases result in recognition of both an asset (often referred to as a right of use asset) and a lease liability in the books of the lessee at the commencement date. Now, let's look at the accounting treatment for a capital lease.

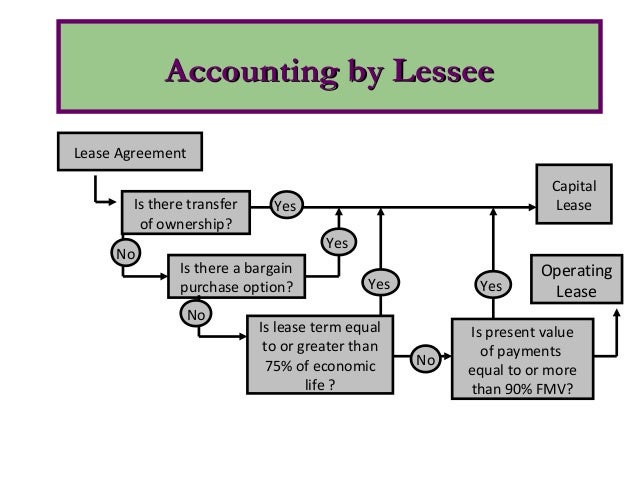

Capital lease accounting deals with the treatment of an asset rented by a business under the terms of a capital lease agreement.

The lease liability will be calculated as the present value (PV) of the future lease payments discounted using an appropriate rate.

Capital leases are a bit more complicated. The new guidance requires lessees to recognize substantially all leases on their balance sheets as lease Example - Short-Term Lease Exception Permitted ABC enters into a contract to lease a piece of construction equipment Today's capital leases will be classified as finance leases, and today's. Delta transactions if treated as a capital lease.