Capital Gains Worksheet Real Estate. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. Use SmartAsset's capital gains tax calculator to figure The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

Capital gains tax varies by residential status.

Use SmartAsset's capital gains tax calculator to figure The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

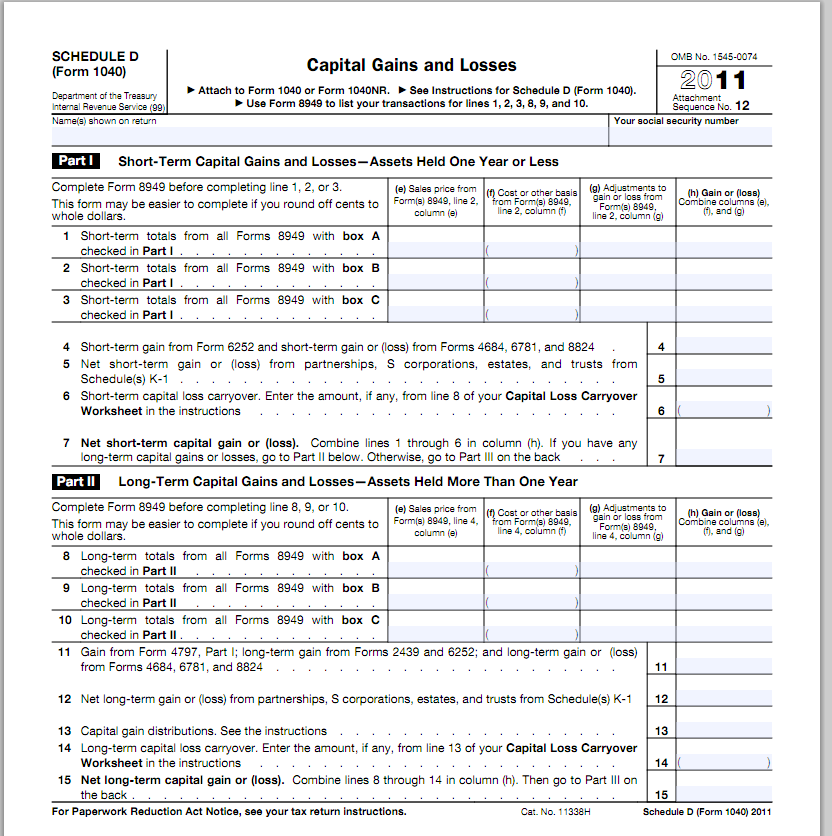

These instructions explain how to complete Schedule D •• To report a gain or loss from a partnership, S corporation, estate, or trust; To report capital gain. This is not to be confused with the ordinary income that these investments may also. The idea behind these rules is to incentivize people to invest for the long-term in real property or assets.