Capital Gains Tax Rate Worksheet. It relies on the fact that money you lose on an investment can offset your capital gains. That's because lawmakers wanted investors to have an incentive to invest for the long run.

The rate you pay on long-term capital gains varies based.

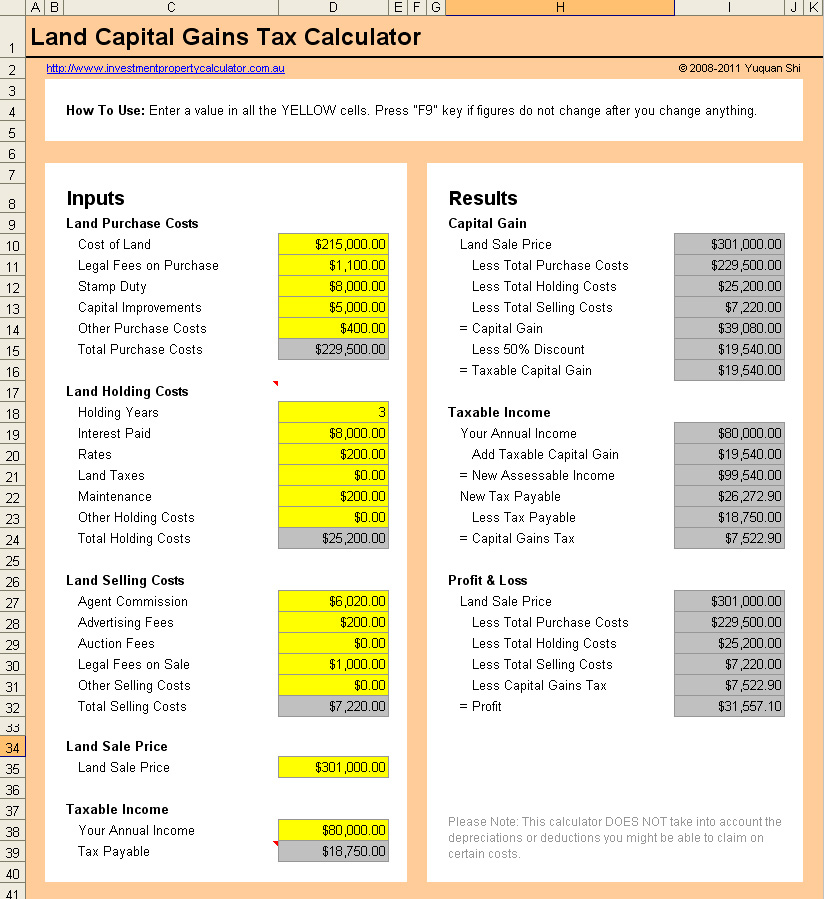

The capital gains tax takes a percentage of all realized capital gains.

If you realize a profit on assets held one year or less (short-term capital The federal tax rate for your long-term capital gains are taxed depends on where your income falls in relation to three cut-off points. Whereas a capital gain increases your income on your tax return, a capital loss counts as a deduction. No, the tax rates apply first to your "ordinary income" (income from sources other than long-term capital gains or qualifying dividends) so.