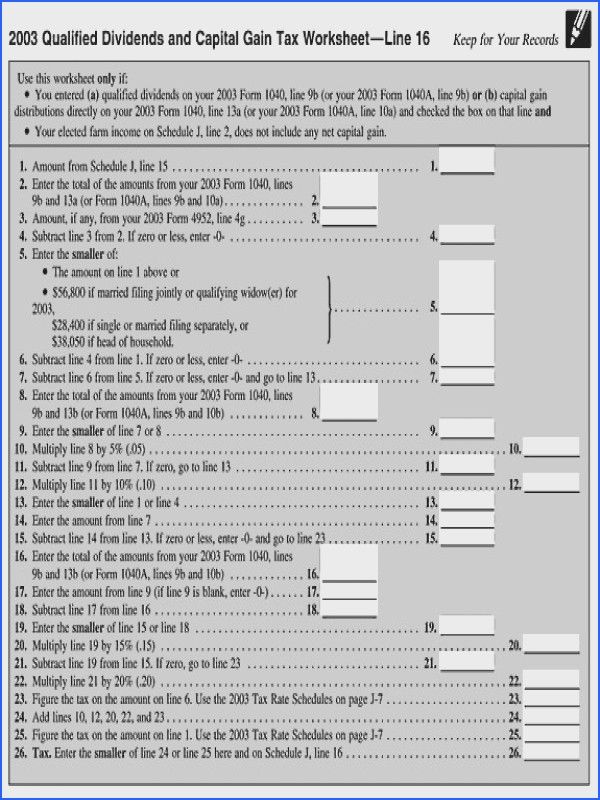

Capital Gains Dividend Worksheet. Both capital gains and dividend income are sources of profit for shareholders and create potential tax liabilities for investors. Capital Gains Reserve Worksheet - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

Use the statement provided to enter multiple payers and type codes.

Additional costs you paid toward the original purchase (include transfer fees, attorney fees, and inspections but not points you paid on your mortgage).

When you prepare your return on eFile.com, we will calculate the gains and losses and prepare the Schedule D for you and it will be efiled with the rest of your return. Capital Gains Reserve Worksheet This worksheet calculates the allowable capital gains reserve, where a portion of the proceeds from an asset disposition are not receivable until after the tax year. Like every other choice, it is like two sides of a coin.