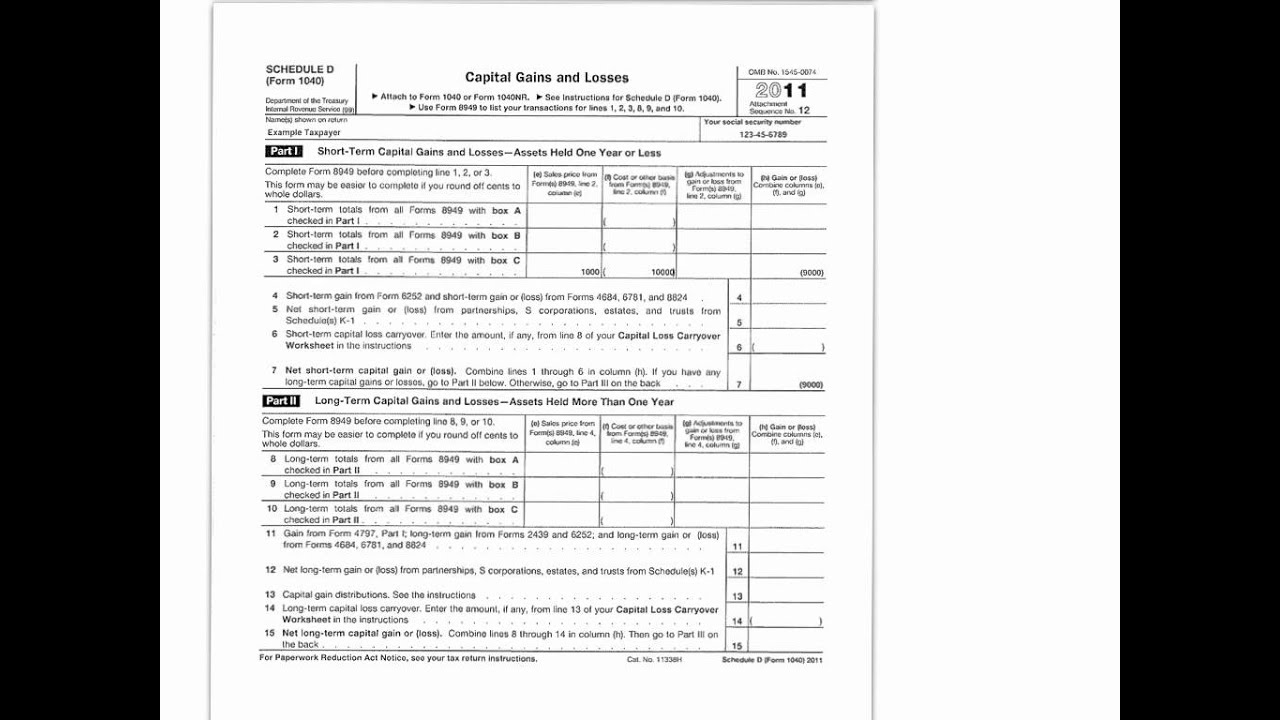

Capital Gains Carryover Worksheet. There is also a Carryover Worksheet showing the carryover from the prior year and the current amounts. The balance above this limit can carry over The IRS provides a Capital Loss Carryover Worksheet in the Instructions for Schedule D.

If I have a capital loss carryover, can I pick and choose when to use it.

When you prepare your return on eFile.com, we will calculate the gains and losses and prepare the Schedule D for you and it will be efiled with the rest of your return.

The use of a carryover loss to offset current year capital gains or ordinary income is not optional, but must be applied according to the rules. The balance above this limit can carry over The IRS provides a Capital Loss Carryover Worksheet in the Instructions for Schedule D. Remember the carryover For future years, you'll want to be sure to make notes on how much of your carried-over losses were short-term and long-term.