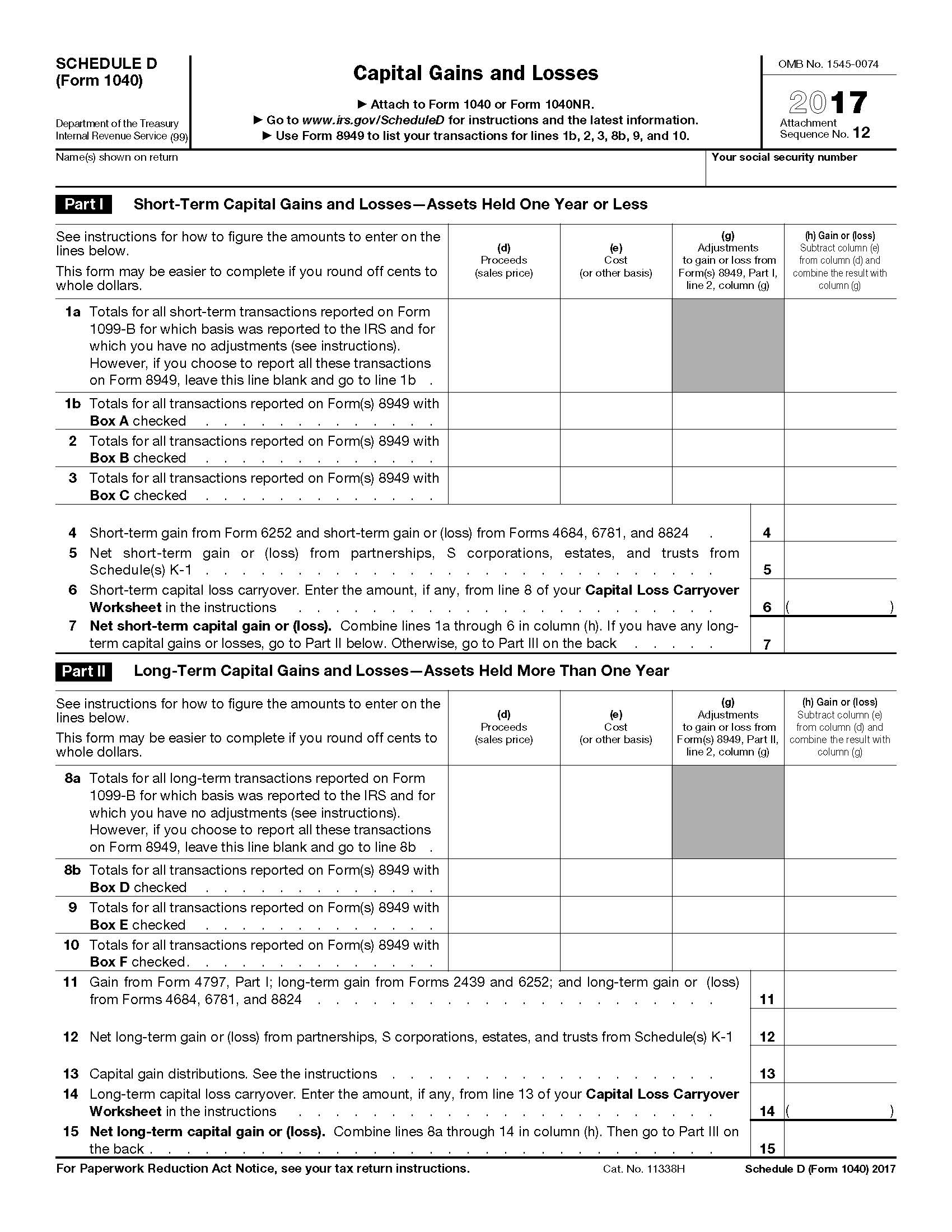

Capital Gains And Losses Worksheet 2010. Worksheet will open in a new window. Information about Schedule D and its separate instructions is at www.irs.gov/scheduled.

A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate.

Some of the worksheets displayed are Schedule d capital gains and losses, And losses capital gains, Capital gain or capital loss work, Capital gain or Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download.

For example, if you sell two stocks in a year, one at a. California does not have a lower rate for capital gains. Schedule D Capital Gains and Losses.