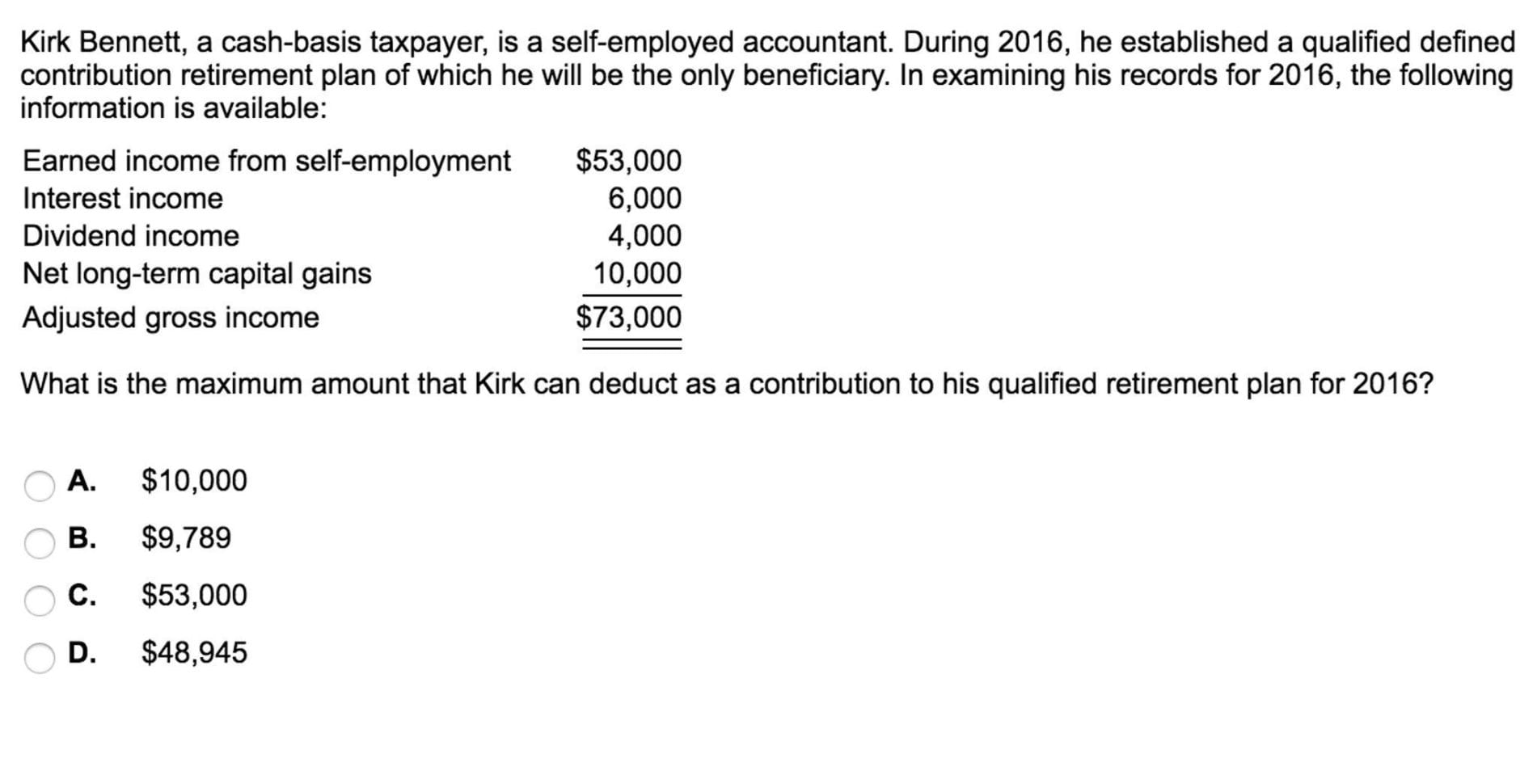

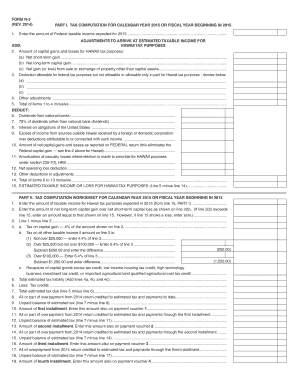

Capital Gains And Disbursement Quota Worksheet. See how the math works and ways to organize your investment data for tax purposes. How do I enter sales of capital assets on the Schedule D Capital Gains and Losses Smart Worksheet?

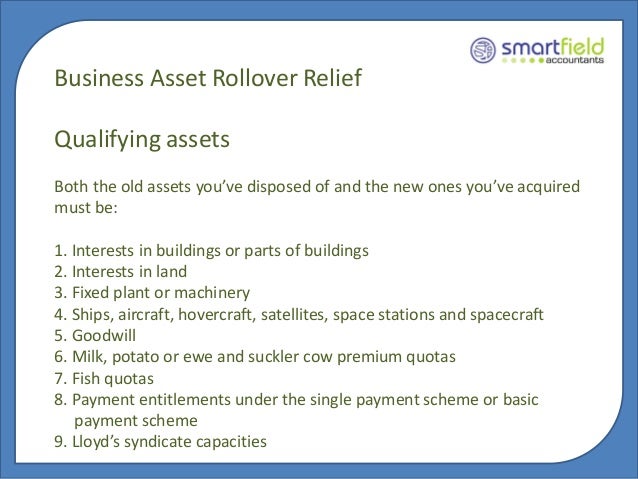

How much these gains are taxed depends a lot on how long you held the asset before selling.

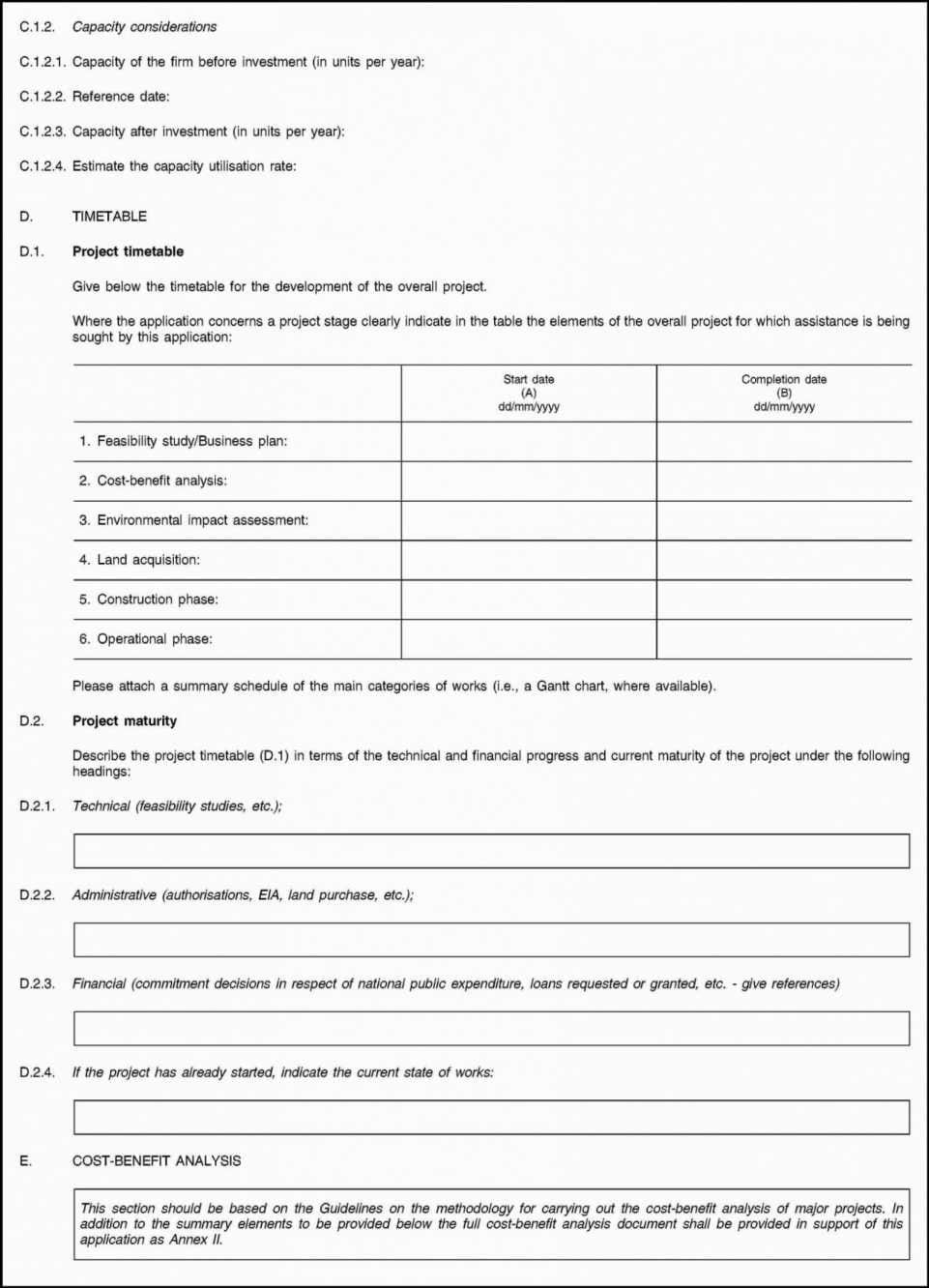

Accordingly, the attached statements do not reflect the liabilities and.

This worksheet calculates the This worksheet calculates the allowable capital gains reserve, where a portion of the proceeds from an asset disposition are not receivable until after the tax year. A disbursement is the paying out of funds, whether to make a purchase or other transaction. The following worksheet is provided to help a charity track its capital gains, determine if it has met its disbursement quota for the fiscal period, estimate The worksheet is provided for your use only.