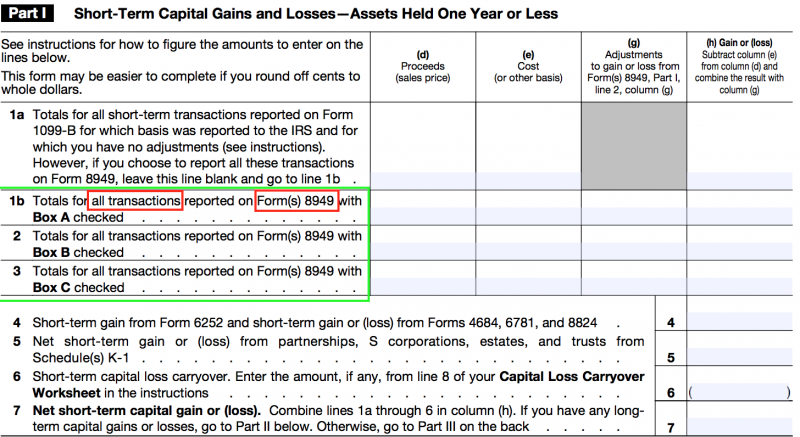

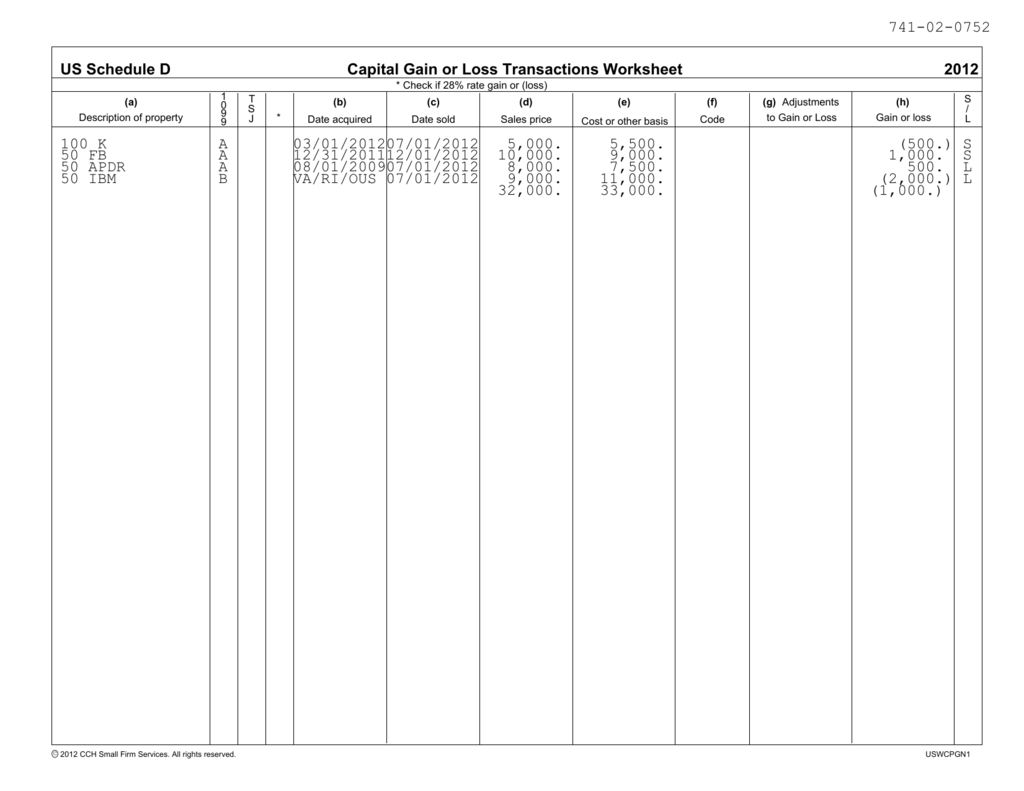

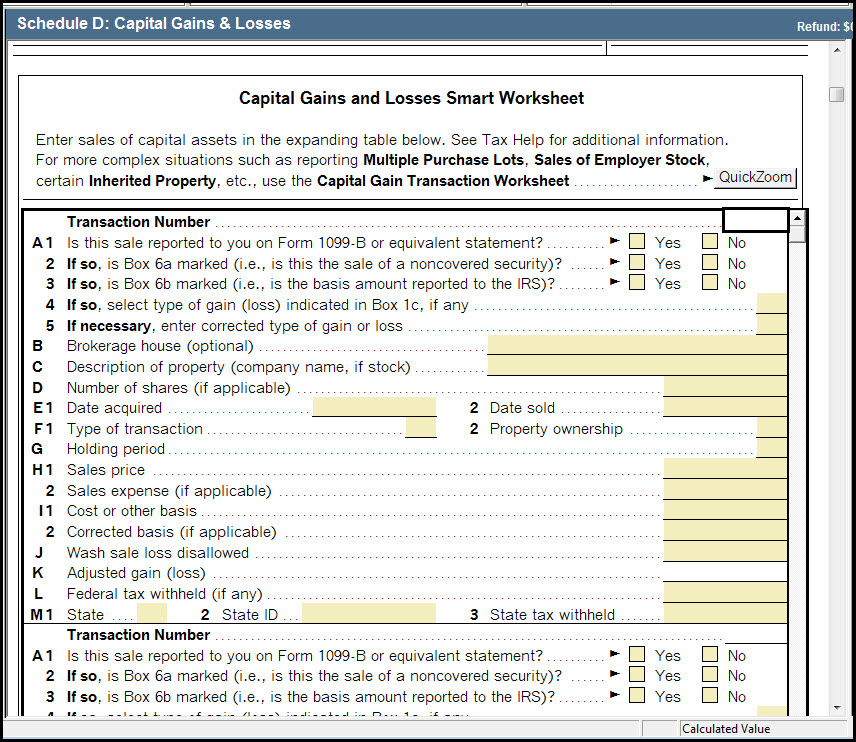

Capital Gain Loss Transaction Worksheet Instructions. Capital Gains and Losses Condensed Entry Table. If you use spreadsheet software, use formulas to calculate gain or loss using the.

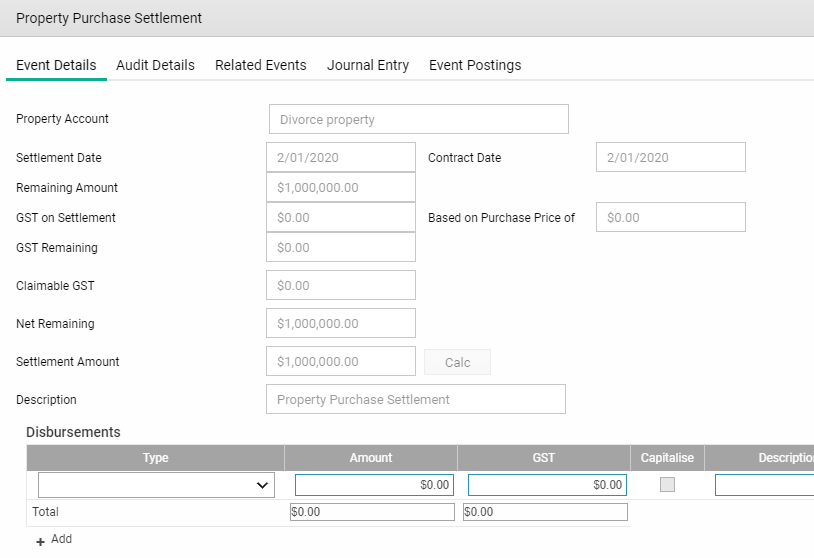

Click Add to create a new form, or Enter the transaction information on the proceeding screens and select the appropriate adjustment If you enter more than one code in column (f), see More than one code in the instructions for column (g).

You may owe capital gains taxes if you sold stocks, real estate or other investments.

You can use capital losses to offset capital gains during a taxable year, allowing you to remove some income from your tax return. If you use spreadsheet software, use formulas to calculate gain or loss using the. Use this worksheet to enter sales of investments and other capital assets NOT related to a specific For special situations such as multiple Purchase Lots and sales of Employer Stock, the Capital Gain (Loss) Transaction Worksheet may be used to.