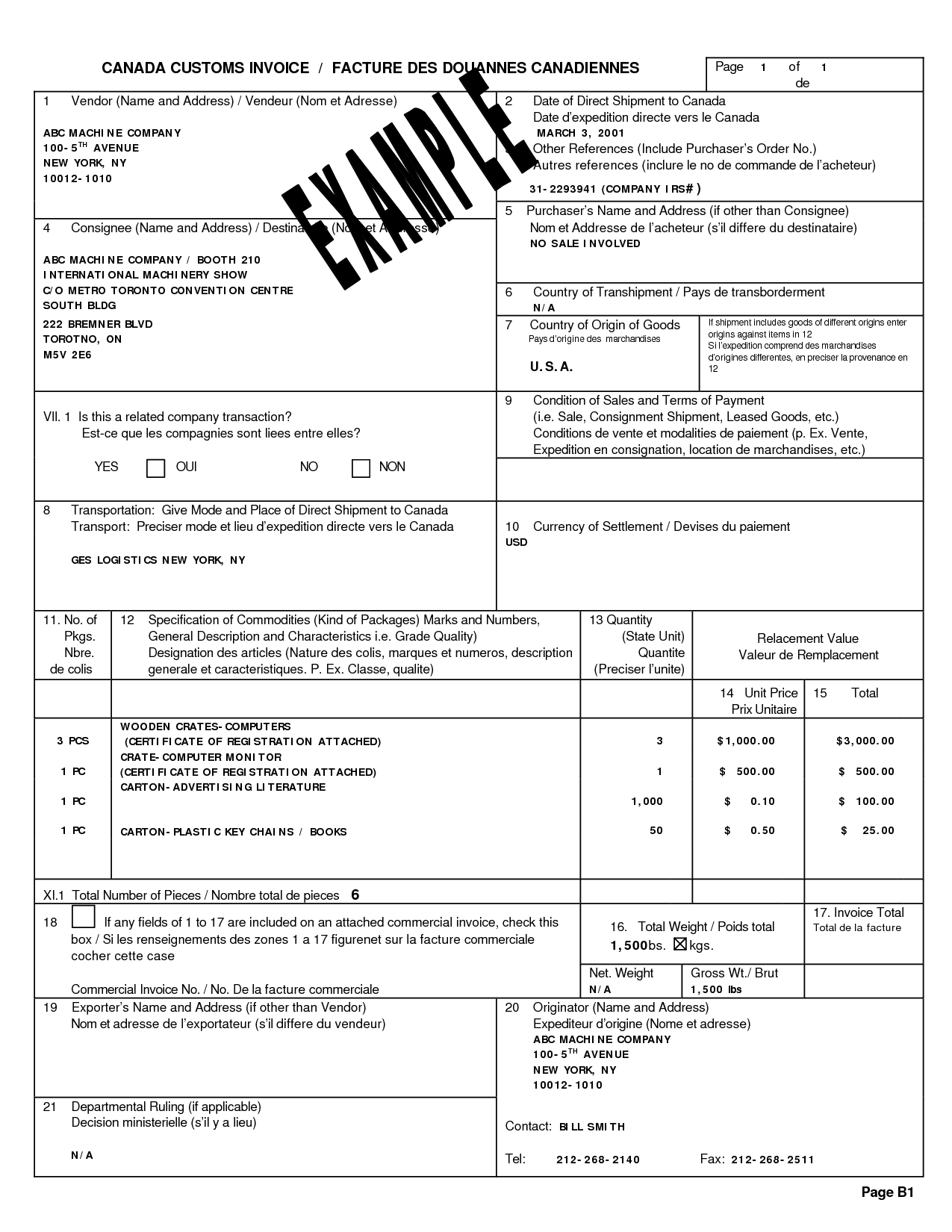

Canadian Customs Invoice Example. Revenu Canada Douanes et Accise FACTURE DES DOUANES CANADIENNES of/de____. Just set the necessary time aside to get it right, and remember that if you don't do it, your goods might get stuck at the You should also remember that a Canadian customs invoice form isn't actually your only invoicing option.

Goods you import into Canada are subject to the GST or the federal part of the HST, except for items specified as non-taxable importations.

Download customs clearance forms, NAFTA certificates and other essential documentation from the links provided below.

Exporter's Name and Address (If other than Vendor). Generally, Canadian invoices should inform customers of the price of the goods or services they're purchasing and the amount of tax they're paying on If you do business in a province that charges GST and PST, you may also qualify for a provincial small supplier exception. Need help completing your Canada Customs invoice?